Stock Market

Turn your interest in investing into expertise and confidently analyze, trade, and navigate the stock market with our comprehensive program.

- 1K Student already enrolled

4.9/5

Start Your Learning Journey Now!

2-3 Months

Program Duration

Certifications

2

Industrial Projects

4-6

Internship Partners

100+

Quiz/ Assignments

Lifetime

Program Access

Program Curriculum

Week 1: Stock Market Basics

Introduction to the Stock Market

- What is the stock market? How does it work?

- Brief history and evolution of the stock market in India and globally.

- Understanding stock exchanges (NSE & BSE) and their roles.

Why Should One Invest?

- The importance of investing for wealth creation and beating inflation.

- How investments grow over time through compounding.

Savings vs. Investing

- Key differences between saving money in a bank vs. investing it in assets.

- Pros & cons of both approaches.

Investment Avenues

- Overview of various investment instruments: Stocks, Bonds, Mutual Funds, ETFs.

- When to choose each based on goals & risk profile.

Types of Mutual Funds

- Categories like equity, debt, hybrid, index funds, and their benefits & risks.

Getting Started

- Step-by-step guide to opening a Demat & Trading account.

- Choosing the right broker/platform.

Key Terminologies

- NSE, BSE, IPO, Sensex, Nifty – what they mean and why they matter.

Key Terms & Concepts

Market order, limit order, stop-loss, dividends, volatility, and market capitalization explained in simple terms.

Week 2: Fundamental Analysis

Objective:

Types of Companies & Investment Styles

- Understanding blue-chip, mid-cap, and small-cap companies.

- Investment styles: value investing, growth investing, swing trading – what suits which investor profile.

Analyzing a Company

- Key financial ratios to assess a company:

- Price-to-Earnings (P/E) ratio

- Return on Equity (ROE)

- Debt-to-Equity ratio

- Real-world examples to interpret these ratios.

Holding Patterns

- Who owns the company? Understanding the significance of FII (Foreign Institutional Investors), DII (Domestic Institutional Investors), and Promoter holdings.

Research Tools & Reports

- How to read management commentary in annual reports.

- Comparing a company with its peers and understanding its industry position.

- Using mutual fund factsheets & research reports for insights.

Graham Calculator & News Analysis

- Basics of calculating intrinsic value of a stock using the Graham formula.

- How to factor news & market sentiment into your decisions.

Overview of Taxation

- Basics of capital gains tax, dividends tax, and how taxes affect investment returns.

Week 3: Technical Analysis & Derivatives

Basics of Technical Analysis

- Why technical analysis works & how it differs from fundamental analysis.

- Reading candlestick patterns to understand price movements.

- Common chart patterns: double top/bottom, head & shoulders.

Trendlines, Support & Resistance

- Drawing trendlines, identifying support & resistance zones to plan trades.

Indicators & Price-Volume Strategy

- Introduction to indicators: Simple Moving Average (SMA), Exponential Moving Average (EMA).

- Understanding the significance of trade volumes.

- Combining indicators & price-volume analysis for entry & exit points.

Introduction to Futures & Options (Derivatives)

- What are derivatives? Why do traders use them?

- Difference between futures and options contracts.

- How to buy/sell options, basics of strike price & expiry.

Introduction to index derivatives: NIFTY & Bank NIFTY.

Week 4: Smart Investing & Risk Management

Crafting an Investment Strategy

- Combining insights from fundamental and technical analysis to build a strategy.

- Identifying the right valuation and timing for entry.

Portfolio Diversification

- How to spread investments across different asset classes & sectors to minimize risk.

- Balancing investments across large-cap, mid-cap, and small-cap stocks.

Risk Management Essentials

- Setting a maximum risk per trade.

- How to determine the correct stop-loss level.

- Allocating the right % of capital to each stock/trade.

Maintaining a Trading Journal

- Importance of documenting trades, strategies, and learnings to improve over time.

- What to record in your journal: entry/exit prices, reasons, outcomes, emotions.

Hands-on Projects:

Minor Projects :

- Choose some scams and explain it in your language in bullet form.

- How things got changed or improved after those scams

Major Projects:

- Scams of India – How the market reacted to those scams and how the market recovered.

- Identify loop holes in the system and how it was fixed

Note: Project topics may occasionally vary depending on the teaching methodology and the students’ learning progress.

Hands-on Projects:

Minor Projects :

- Choose some scams and explain it in your language in bullet form.

- How things got changed or improved after those scams

Major Projects:

- Scams of India – How the market reacted to those scams and how the market recovered.

- Identify loop holes in the system and how it was fixed

Note: Project topics may occasionally vary depending on the teaching methodology and the students’ learning progress.

Tools & Technologies that you will learn

- Screener

- TradingView

- Upstox Pro

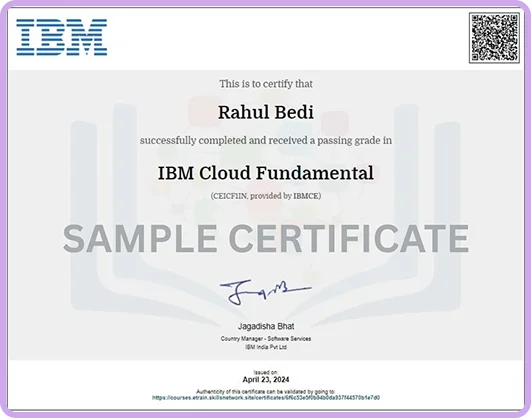

Certificates

Select the Best Plan for Your Growth

Choose the plan that suits your learning needs and start your journey with ShikshaVertex today. Tailored options for every goal and budget.

Self Paced

₹ 5,999

- Recorded Sessions

- Hands-on Projects

- Certifications

- Doubt Clear Sessions

- Live Sessions

- Mentor Guidance

- Placement Support

- 1:1 Mentoring

Mentor Led

₹ 8,999

- Recorded Sessions

- Hands-on Projects

- Certifications

- Doubt Clear Sessions

- Live Sessions

- Mentor Guidance

- Placement Support

- 1:1 Mentoring

Professional

₹ 13,999

- Recorded Sessions

- Hands-on Projects

- Certifications

- Doubt Clear Sessions

- Live Sessions

- Mentor Guidance

- Placement Support

- 1:1 Mentoring

Earn credentials from IBM — give the exam, get certified, and stand out.

What You’ll Get:

- IBM digital certificate recognized globally

- Increased trust and credibility with employers

- Better job opportunities and professional edge

- Stronger profile in web development roles

- Proof of your commitment to upskilling

Price : ₹3000

Our Alumni Works At